Income Tax Calculator 2025-25 Pakistan - 2025 Tax Calculator Irs Ketti Rowena, Calculate your income tax, social security. 15 percent of revenues will be considered deemed income and 29 percent income tax will be applicable on it. D&D Player'S Handbook 2025. Introducing the 2025 player's handbook, the new and improved guide for fifth edition dungeons & dragons. Play dungeons & dragons online with roll20! The new species

2025 Tax Calculator Irs Ketti Rowena, Calculate your income tax, social security. 15 percent of revenues will be considered deemed income and 29 percent income tax will be applicable on it.

Oakland County Fireworks 2025 Dates. Detroit tigers fireworks at comerica park. Looking for “fireworks near me” in oakland county? Fireworks show is at dusk july 5, following concert by grant

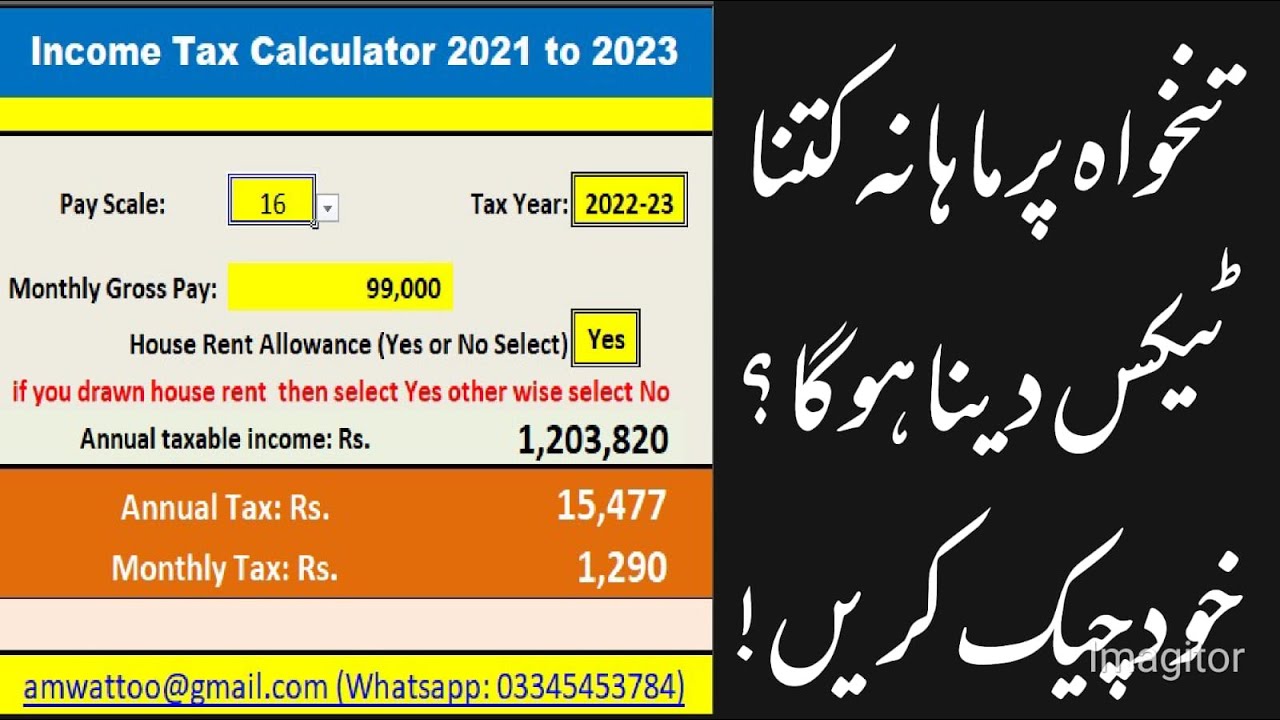

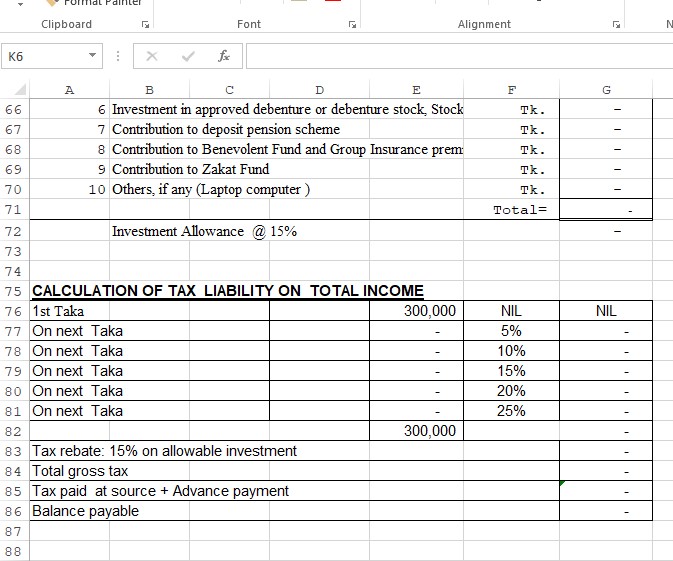

Tax Calculator FY 20232025 How to Create Tax, The recent modifications to income tax brackets for employed. You can view your income tax calculation using the income tax.

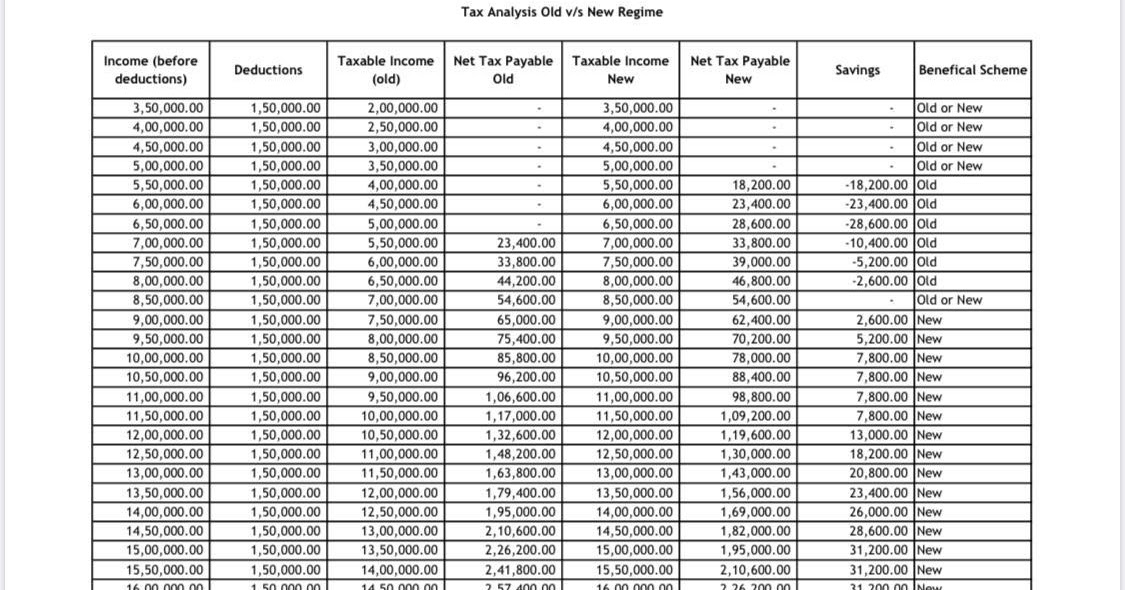

Those earning between rs600,000 and rs1.2 million annually, the income tax rate has been increased to 5%.

Tax Calculator 202525 Excel Silva Dulcinea, Learn more about tax slabs Use our calculator to determine your annual and monthly tax, including income after tax deduction

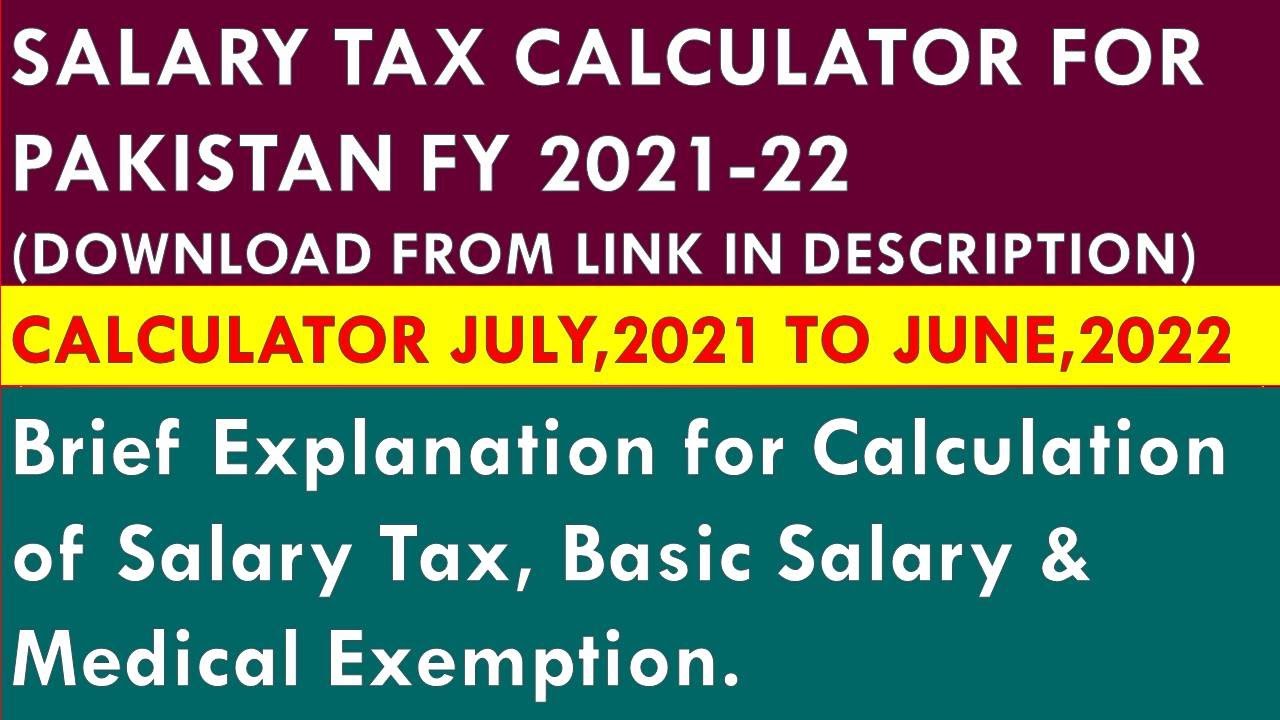

Salary Tax Calculator Pakistan Tax Slab Fy Archives Hot Sex, Income tax rates in pakistan are progressive, meaning that higher levels of income are taxed at higher rates. Calculate monthly income and total payable tax amount on your salary.

Tax Calculator Pakistan For 2023 2025, Calculate your monthly or annual income. Income tax calculator for fy25.

A StepbyStep Guide To Using The Tax Calculator In Pakistan, Hybrid vehicles to cost more reduced rates of 8.5% for engines up to 1800cc. Calculate your income tax, social security.

Wizard101 Discount Code 2025. Save big w/ (18) wizard101 verified promo codes & storewide coupon codes. Ki codes tend to expire very fast, so you want to keep on top

Those earning between rs2.2 million and rs3.2 million annually will face a 25% tax rate and a fixed tax of rs180,000 annually.

Your calculated tax will appear here. Individuals with a monthly income.